Inflation has been on the rise over the past months, and economic data is now confirming the inflationary trend is impacting businesses, governments, and households worldwide.

With my own clients and connections, I have been hearing horror stories of companies that have fixed prices too far out or been too slow in putting up their prices. We are also starting to hear the impact that is happening in the construction industry. The results are reduced bottom line profits and reduced cash in bank balances.

Most of those who are employed in management positions today do not have the experience of managing company during inflationary times. In this blog, I wanted to share what I have learned during my 30+ years in business.

An Important Lesson Learned

When I was 18 years old, I was put in the role of costings:

- Imported products – every product

- Locally manufactured products – every product

- Overheads costed each month and applied to products as an overhead percentage. Then gross profit margin was applied.

As you can imagine, we did not have the technology of today so I had to do this manually. Inflation was higher in those years compared to now. However, we did not have a tight labour market putting pressure on wages and wage increases, like today.

The General Manager of the business went through an exercise with me, explaining and showing the impact of inflation on the company’s cash and how quickly the company could run out of cash. What I learned is Cash = Oxygen. Without it, you die as a company.

Lessons from the Past

Prices were rising continuously; it was like climbing a staircase over the 18 months I was in the role. As soon as we knew the price of new stock in transit, we applied the latest overhead factor percentage and then the margin to set the new price. Then we put the price up of existing stock on the shelf and any other stock in transit to the same price.

Sometimes all existing stock went up by a percentage so we had the cash to pay for the new stock. If we didn’t do this we would have run out of cash. Some of my clients have been doing this for the last 6-8 months to keep the cash in the bank.

Reflecting on my role then, I remember that back in those days our sales people were sent out to pick up cheques in many situations. The cheques were banked that same day and we paid to get a fast cheque clearance (24 hours) at the bank before we shipped the product.

We stopped printing price lists because they were out of date so quickly and it was a big cost to produce them, there was not the technology available then that we have today.

A saying I have remembered is: “In order to maintain the purchasing power of future cash receipts, the cash received must be inflated”.

What this means is, put the price of current stock up so you can to pay for the higher priced stock, raw materials, labour, without reducing your available cash, cash in the bank level or balance.

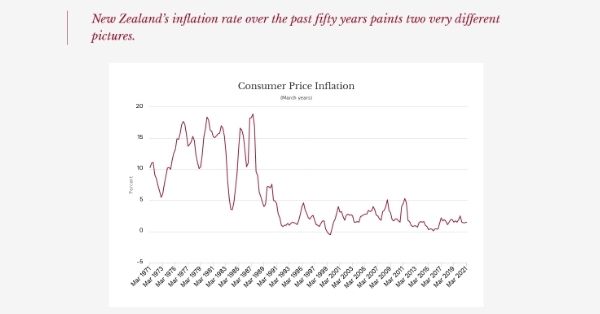

Graph of inflation in the 1970’s and 1980’s

Advice for the Present

With New Zealand’s inflation still rising, it is important to not under estimate the impact of compounding inflation in small percentages, month after month. The result is little by little your available cash will be reducing adding up to a lot of money gone. Once that money is gone, it is gone, you cannot get it back.

The point I want to make here is that we must increase prices to protect our cash and losing cash can happen over a period of time, 6 to 12 months. It will be a large total lost though.

Talking recently with a past mentor who is now retired about managing in inflationary times, he said, “Watch & stay on top of compounding inflation each month. It is like a hiding snake; you don’t see it & then it bites you when you don’t expect it. This is what we meant about watching the pennies – not cost cutting – watch your compounding inflation and adjust accordingly. Protect your cash.

Know Your Labour Efficiency Ratio

Inflation at present is affecting just about everything including wages and salaries. It is affecting every industry type including services companies. All companies should be measuring their Labour Efficiency Ratio (LER).

In inflationary times and tight labour markets, knowing and measuring your LER can be crucial, to keep efficiency, be profitable, and prevent your cash reducing. This is an important KPI or ratio that I have most of my client’s measure.

LER will immediately show you the impact of wage & salary increases on your gross profit. Labour Efficiency Ratio is Gross Profit divided by Direct Labor (expense). This will become an important number for your business in order to keep Labor Productivity as high as possible and protecting your cash position.

What does the Labor Efficiency Ratio do for companies? It measures the productivity of your labour force through time (trends, changes) and can be used to tune (optimise) your economic engine for maximum profitability. You can focus the labour efficiency ratio on sub-categories of labour within your company – the most common being Manufacturing/production labour, Management Labor, Delivery labour and Sales labour.

Helpful Resources

To understand more on LER’s read Simple Numbers 2.0 by Greg Crabtree. Purchase Book.

There are other things you can do in inflationary times to protect your financial position and grow. Learn more about the 7 Actionable tactics to counter inflationary threat.

Another book that I highly recommend company leaders read, especially in inflationary times is CASH, The Fuel for Your Economic Engine, a part of the Gravitas Impact Monographs collection.